HealthcareMedicareRepublicansTaxes

The Republican Budget Reveals That Their Tax Plan Is Trumpcare In Reverse

The tax handout to millionaires will balloon the deficit, which in turn will provide an excuse to demand cuts to Medicare and Medicaid.

[dropcap]D[/dropcap]uring the GOP’s failed efforts to enact Trumpcare, the legislation was endlessly described as a health care bill. It was not. As numerous nonpartisan analyses made clear, it was a bill to weaken Americans’ health care in order to free up money to pay for tax cuts for the rich. Having failed to pass a bill that would have taken away health care from tens of millions of Americans to give a giant tax cut to the wealthy, Republicans are now trying to do the same thing in reverse.

Although the details of the so-called “tax reform” bill are still sketchy, enough has been released to make clear that the Republicans are planning an enormous tax giveaway to billionaires and giant, profitable corporations. The tax handout will increase the deficit, which in turn will provide the GOP with an excuse to demand cuts to Medicare and Medicaid.

This strategy is laid out in plain sight. The House Republican Budget, which is scheduled for a vote tomorrow, proposes huge tax cuts, while gutting Medicare and Medicaid. The budget would raise the Medicare eligibility age to 67 and cut the program’s budget by almost $500 billion. Its cuts to Medicaid are even more massive – up to $1.5 trillion!

The Senate Republican Budget is even clearer. It calls for spending cuts of $5.1 trillion, including $1 trillion in cuts to Medicaid and $470 billion in cuts to Medicare. It also instructs the Finance Committee, which has jurisdiction over Medicare, Medicaid, and taxes, to report out a bill that “reduce[s] revenue and change[s] outlays” while “increase[ing] the deficit by not more than $1.5 trillion.”

In other words, the Finance Committee will have the power to, at a minimum, reduce taxes by $1.5 trillion. It can cut taxes by even more, if it guts Medicare and Medicaid. And, as Congress tried to do with Trumpcare, all of these changes could be made through the so-called reconciliation process, so that Senate Republicans can pass what they want with a simple majority, freezing out the Democrats.

Trumpcare focused our attention on health care, while also cutting taxes for the wealthy. This new effort focuses our attention on taxes. On that front, what is being proposed is obscene. Cutting taxes substantially for those at the very top and for their heirs obviously make the rich even richer, in a country already facing immoral and destabilizing income and wealth inequality.

Trump himself will become even richer, if the tax plan becomes law. Though he has refused to release his tax returns, enough is known about his business dealings and his 2005 tax return to estimate that he and his family will be at least a billion dollars richer, if his tax proposal becomes law. Trump’s cabinet members, including billionaires Wilbur Ross, Betsy DeVos and Linda McMahon as well as a dozen multimillionaires serving in this administration, would also benefit hugely from the plan.

Additionally, Trump’s children and those of his cabinet members would become substantially richer, since the bill calls for the repeal of the estate tax. President George W. Bush and his Republican-controlled Congress already watered down the estate tax so much that it currently covers the estates not of the top 1 percent, not of the top 0.5 percent, but only of the top 0.2 percent. But that still requires the Trump, Ross, DeVos, and McMahon families to pay. So the tax bill simply eliminates it completely.

Contrary to the lies Trump is using to sell the plan, it does not offer the same tax benefits to working and middle-class Americans. In fact, it would increase taxes for many families not as rich as Trump and his cabinet. Adding insult to injury, it would raise taxes on much of the middle class while threatening all of our economic security.

The tax bill, if enacted, will blow a hole in the federal budget, adding trillions to the deficit. History teaches us what Republicans will do next: Point to the huge deficit they created and say that it means we must cut “entitlements,” a pejorative term for Medicaid, Medicare, and Social Security.

This is part of a strategy concocted decades ago, known as “starve the beast.” The “beast” is the federal government and all of the federal programs that serve us. “Starving” it means cutting taxes, so the government and all of our important programs no longer have the resources they need to do their job. Right-wing activist Grover Norquist, whose pledge never to raise taxes has been signed by nearly every Republican in Congress, said it unabashedly: ““I don’t want to abolish government. I simply want to reduce it to the size where I can drag it into the bathroom and drown it in the bathtub.”

Republican elites have substantially cut vital domestic discretionary spending, including research, infrastructure, national parks, education, and assistance, and want to cut them even more. They have not yet been able to achieve their goal of gutting Social Security, Medicare, and Medicaid, despite a war on all three programs that has been raging since they were enacted. Republican elites have failed in this effort because these programs are important to and extremely popular with the American people. But they certainly haven’t given up. Though they have not succeeded in ending these programs, their lies have succeeded in undermining many people’s confidence that they will be there for us in the future.

Social Security does not add a penny to the deficit, but Medicaid is fully funded from general revenue and Medicare is funded partly from general revenue. Therefore, if Trump and his fellow elites succeed in increasing the deficit, they will unquestionably follow it — or even accompany it — with a deficit reduction bill which cuts spending. Where will they make those cuts? They have already cut domestic discretionary spending down to the bone, and they have no interest in cutting military spending. That leaves Medicare and Medicaid. And they will use the deficit as an excuse to go after Social Security, despite the fact that it has nothing to do with the deficit.

Again, they have telegraphed their intention. The Senate Budget proposal being pushed by Republicans cuts over $450 billion from Medicare. The House Budget goes even further, repealing and replacing Medicare and Medicaid.

These attacks on our economic and health security should not be a surprise to anyone. Only days after the election, Speaker Paul Ryan made it clear that he viewed Trump’s presidency as an opportunity to realize a long-held dream of his: Destroy Medicare by replacing it with inadequate vouchers for private insurance.

The attack on Medicaid has been even more blatant. Although Republicans claimed the purpose of Trumpcare was to repeal and replace the Affordable Care Act, every single version of the bill included massive cuts to Medicaid. The huge cost of the Republican tax giveaway plan, once enacted, will serve as their latest excuse to destroy Medicare and Medicaid. And though Social Security does not add a penny to the deficit, Republicans will use the deficit to go after it, despite the illogic.

What Trump and his fellow Republican elites want is more money in their pockets, the health and economic security of the American people be damned. Never mind that all of us have paid for the bridges, roads and highways, police and fire protection, the court system and all the rest of the infrastructure that makes the accumulation of wealth possible.

Cutting taxes while weakening Americans’ health and economic security has been a consistent goal of Trump and his Republican Congress since taking office in January. There’s no better symbol of this agenda than Trump Supreme Court nominee Neil Gorsuch’s decision to speak at the conference of a conservative “limited government” organization. The conference took place at the Trump Hotel in Washington, meaning that it put money right into Trump’s pockets while simultaneously advocating for taking money out of the pockets of working and middle class Americans.

Trump’s tax plan is exactly the opposite of what our country needs at this moment in history. Americans overwhelmingly agree that it is time to increase, not cut, the taxes for those at the top: Millionaires, billionaires, and giant corporations. We need to insist that those at the top pay their fair share, rather than be given even more of a free ride.

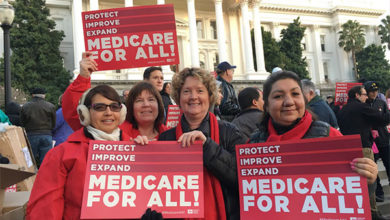

We are the wealthiest nation in the world at the wealthiest moment in our history. We also remain, despite efforts to suppress our votes and rig our elections, a country of one person, one vote. If the American people rise up and demand that those who represent us require the wealthy to pay their fair share, the rewards will be great. We will be able to expand Medicare to cover all Americans, expand Social Security to address the retirement income crisis, and restore the cuts to other domestic spending programs.

In attacking NFL players fighting for social justice, Donald Trump tweets about patriotism. But to be truly patriotic, he and his billionaire cronies should stop trying to siphon more of our common wealth into their pockets. Rather, they should start paying their fair share for the common good of all.