[dropcap]T[/dropcap]he hypocrisy of some prominent politicians helps explain why the public holds all of them in such low repute. Senator Bob Corker (R-TN) was a deficit hawk, voting against his Party’s tax scam, until his vote was needed. Then, his “heartfelt” deficit concerns miraculously disappeared.

The same hypocrisy surrounds the issue of income and wealth inequality. Republicans were supposedly concerned about it, until their donors gave them marching orders. The product: a tax scam that will make the plutocrats even richer, both in absolute terms and in comparison to the rest of us.

In 2013, President Barack Obama warned that “a dangerous and growing [income and wealth] inequality and lack of upward mobility” are “the defining challenge of our time.” Since Obama delivered that message, the share of the wealth owned by the top one percent has increased by nearly three percentage points, while the wealth of the bottom 90 percent has fallen. Indeed, the top one percent has more wealth than the entire bottom 90 percent, put together.

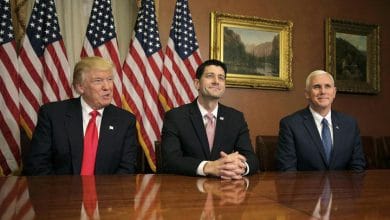

Paul Ryan, Marco Rubio and other Republicans were quick to jump on the inequality bandwagon, when it suited their political interests. In 2015, Ryan expressed his concernthat income and wealth inequality were growing, that the rich were getting richer, while everyone else was remaining in place. He even seemed to belittle trickle-down economics, stating, “The wealthy are doing really well. They’re practicing trickle-down economics now.”

Similarly, Senator Marco Rubio (R-FL), expressed his concern about the lack of upward mobility resulting from our obscene and growing income and wealth inequality. In 2014, he said that “what troubles us now is that – research now shows – there are other countries where the circumstances of your birth matter less than they do here.” He insisted that, “we don’t want to accept that, and we shouldn’t accept that.” Ironically, he even declared his support for using the tax code to help struggling families catch up.

Where are Ryan, Rubio and the other hypocrites now? Rubio made a big, eleventh-hour splash by insisting that the Child Tax Credit be improved. How did that go? To his credit, he got a few more crumbs for the poorest. That was enough for him to vote in favor of the trillions the wealthiest will get. Just Trump and his children alone will apparently gain billions. Thanks to the Rubio demand, the poorest among us will get an additional $25 a month. That was good enough for Rubio.

Ryan, Corker, and the others didn’t even demand the Rubio crumb. All of them are eager to vote for a bill that will reduce the marginal rates of the richest of the rich while the poorest of the poor get no reduction in their marginal rates whatsoever. Individuals with annual taxable incomes in excess of $426,700 and married couples with annual taxable incomes in excess of $480,050 get lower marginal rates. What about individuals with annual taxable incomes below $9,525 and married couples with taxable incomes below $19,050? Their marginal rates don’t go down by even a trillionth of a percent!

Overall, the tax scam will require millions of middle class Americans to pay more, while requiring the richest of the rich to pay less. The upward redistribution of wealth is close to dollar-for-dollar. In 2027, for example, taxpayers with incomes between $40,000 and $50,000 will, as a group, pay around $5.3 billion more in taxes, while those with annual incomes of $1 million or more will pay around $5.8 billion less!

And that is only one part of the apparent plan to increase, not decrease, income and wealth inequality. While Republicans work to ensure that the children of plutocrats can inherit their parents’ wealth while paying little or no tax, they want to reduce our earned Social Security and Medicare benefits. Ryan and Rubio stated so publicly.

Social Security and Medicare are essential to our economic security. Social Security protects people from falling into poverty as the result of death, disability, or old age. Medicare assures that seniors and people with disabilities are not one illness away from destitution, as they once were.

Our rising income and wealth inequality is not a mystery. It is clear what is causing it. It is clear what we can do to curb it. If politicians have genuine concerns about the economic security of the American people and about growing income and wealth inequality, they should expand both Social Security and Medicare, and require the wealthiest to pay their fair share.

But they are working to do the opposite: cut Social Security and Medicare, while requiring the wealthiest to pay less. Those who recognize that we are living in a rigged system, who see themselves running in place or, worse, falling behind, while the Koch brothers, the Trump family, and other billionaires get richer and richer, must join the resistance. Those who are already resisting must work even harder.

Though the billionaires have the money – and will get even more, if the tax scam becomes law – we have the numbers. If we continue to mobilize and fight, we can vote out those who vote for this tax giveaway to their donors, and vote in candidates who are committed to increasing Social Security and Medicare. This is a defining moment.