RepublicansSocial SecurityTaxes

Trump Attacks Social Security While Millionaires Get a Valentine

[dropcap]A[/dropcap] minimum wage worker making $7.25 an hour contributes to Social Security all year long. So do all Americans who make less than $128,400 a year. But those who make over $1 million dollars a year stopped paying in this week, a gift from Uncle Sam to the super-wealthy.

This “Valentine’s Day for millionaires” is always a grim anniversary for the rest of us, but never more so than this year, when it was preceded by an enormous tax giveaway to millionaires and billionaires and when it coincided with the release of Donald Trump’s FY2019 proposed budget. Trump’s budget would cut Social Security, Medicare, and Medicaid by over $1.8 trillion. It also would cut heating assistance, Meals on Wheels, and other vital benefits that seniors and Americans with disabilities rely on every day.

The Trump Administration claims our nation can’t afford these essential programs. That’s despite the fact that they just gave a $1.5 trillion tax giveaway to billionaires and giant corporations. Republicans claim that we can’t afford Social Security and so benefits must be cut. This, despite the fact that millionaires will not be paying a single penny into Social Security for the rest of the year.

As income and wealth inequality has increased over the last four decades — an upward redistribution to the richest among us — it has cost our Social Security system billions of dollars each year. In 1983, 90 percent of all earnings were under the payroll tax cap. Today, less than 83 percent are. A new report, released by Rachel West, Rebecca Vallas, and Eliza Schultz of the Center for American Progress this week, finds that if the cap had continued to cover 90 percent of earnings, Social Security’s trust funds would have $1.3 trillion more today.

CAP’s report also found that if Donald Trump’s income is as high as he claims (impossible to verify since he refuses to release his tax returns), he stopped paying into Social Security on January 1. So did his billionaire Treasury Secretary, Steven Mnuchin. Secretary of State Rex Tillerson stopped paying in on January 2nd. Trump donor, and accused sexual predator, Steve Wynn stopped paying on January 3rd.

The truth is even bleaker than those numbers show, because most members of the top 1 percent don’t earn the bulk of their income in wages. Unearned investment income is not subject to Social Security contributions, resulting in many millionaires and billionaires contributing less to Social Security than hard working Americans do.

A budget is a moral document. Despite what Donald Trump’s budget claims, our country can fully afford Social Security, Medicare, Medicaid, Supplemental Security Income, Meals On Wheels, Home Heating Assistance, and other programs that improve the lives of millions of Americans. We are the wealthiest nation in the world at the wealthiest moment in our history. We simply need to demand that the wealthiest contribute their fair share.

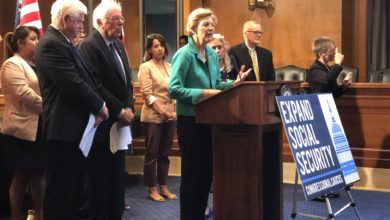

Voters, regardless of political affiliation, are united in their support for these vital programs. Seventy two percent of Americans support expanding Social Security’s modest benefits and paying for it by requiring the wealthiest to contribute their fair share. In contrast, tax cuts for the wealthy and corporations are incredibly unpopular.

Congressional Republicans and the Trump Administration think they can get away with working to enrich themselves and their donors, while ignoring the will of voters. The American people must prove them wrong this November.

If we defeat politicians who refuse to remember that they work for us, we can prevent the Trump budget from ever becoming law. If we instead elect politicians who will fight to expand Social Security by making the wealthiest pay their fair share, we can end the “holiday” of Valentine’s Day for Millionaires forever.