RepublicansSocial Security

Trump’s Trojan Horse Attack On Social Security

No one should be fooled by Trump’s campaign promise not to cut Social Security.

[dropcap]A[/dropcap]s part of his tax package, Donald Trump reportedly is planning to propose replacing employee contributions to Social Security with general revenue. The proposal is a Trojan horse: It appears to be a gift, in the form of middle class tax relief, but would, if enacted, lead to the destruction of working Americans’ fundamental economic security.

If Trump proposes this Trojan horse, it would be the newest shot in the ongoing Republican war against Social Security. That war has failed so far. The American people overwhelmingly support Social Security because they appreciate that it provides working families with basic economic security when wages are lost as the result of death, disability, or old age. And it does so extremely efficiently, securely, fairly, and universally.

Having suffered defeat on their frontal attacks against Social Security, Trump and his Republican allies in Congress appear to be contemplating a stealth attack, instead. In the 1980s, Republicans, who had long tried but failed to cut government programs directly, discovered a new tactic. They realized that they could undermine government and eventually force cuts to spending by cutting taxes and, in their words, starve the beast. Now, Trump is making plans to use that same tactic against Social Security.

Not only would the Trump proposal starve Social Security of dedicated revenue, it would ultimately destroy it. Social Security is not a government handout. It is wage insurance that the American people earn, as part of their compensation, and, indeed, pay for with deductions from their pay.

It is instructive to note that the employee contributions are mandated by the Federal Insurance Contributions Act (“FICA”). It is useful to pause and reflect on the name, the Federal Insurance Contributions Act, and the fact that it was enacted in 1939.

It is only relatively recently that policymakers have adopted the practice of naming legislation in the manner of Madison Avenue advertising—titles like the No Child Left Behind Act of 2001, the USA PATRIOT Act of 2001, the Defense of Marriage Act, and the Repealing the Job Killing Health Care Law Act.

In stark contrast, Franklin Roosevelt named his bills plainly and straightforwardly. His tax bills were labeled Revenue Acts, his legislation to ensure the right of workers to unionize was called the National Labor Relations Act, and his Federal Insurance Contributions Act specifies the contributions or premiums workers and their employers pay in exchange for Social Security wage insurance.

It is common today to refer to FICA premiums as payroll taxes, but that is misleading in two respects. First, workers don’t have payrolls. More fundamentally, these are premiums, not mere taxes. Referring to Social Security premiums as taxes blurs the distinction between them and taxes that are held in the general fund and can be used for any Constitutional purpose that Congress chooses.

Unlike those general revenues, Social Security revenues are held in trust and can be used only for Social Security. Because no benefits can be paid unless their cost is covered by Social Security’s dedicated revenue and because Social Security has no ability to borrow money, it does not and cannot add to the deficit.

Trump’s proposal would change all of that. The fact that beneficiaries have purchased their benefits with contributions gives them a strong claim to those benefits. This is essential because there is generally a very long lag time – forty or more years – from the moment workers begin to contribute to Social Security and the receipt of benefits.

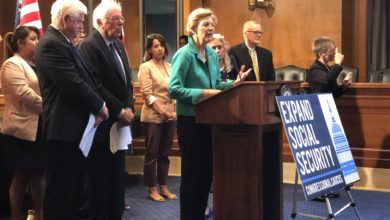

Employee contributions, dedicated to the sole purpose of Social Security, have been part of the program’s fundamental structure from its enactment in 1935. That structure has stood the test of time. If Trump and Republicans truly wanted to help the middle class, they would be expanding Social Security, while requiring the wealthiest among us to pay their fair share. Unlike most workers, who contribute to Social Security from every paycheck all year long, millionaires and billionaires pay on only their first $127,200, and then stop. The very wealthiest earn that amount and stop contributing on their very first work day of the year!

If Trump and Republicans wanted to give working and middle class Americans a tax break, there are much more targeted, efficient ways to do that. They could, for example, reinstate the Making Work Pay tax credit. Under that provision, which has now expired, millionaires, Senators, Representatives, the President, his cabinet, and every CEO of Wall Street banks and Fortune 500 Companies received nothing. Under the Trump proposal, all of them would pocket more than $7,800, while very low-wage workers earning $10,000 would get just $620 and millions of public employees not covered under Social Security would get nothing.

Those numbers tell the story. Trump’s real goal is the destruction of Social Security.

No one should be fooled by Trump’s campaign promise not to cut Social Security. Before he became a candidate, he called it a Ponzi scheme and advocated privatizing it. He chose, as his vice president, Mike Pence, who complained that the Bush privatization proposal didn’t go far enough, fast enough. As President, he has chosen a staunch opponent of Social Security, Mick Mulvaney, as his budget director, and another staunch opponent, Tom Price, as Secretary of Health and Human Services (one of Social Security’s trustees.) This latest proposal is in keeping with his actions and his earlier, more honest statements of his views.

Americans should hold Trump accountable for his promises not to cut Social Security or Medicare. But they should also remember his earlier attacks on these programs, and be on guard for this, and other, Trojan horses that would promise working Americans “gifts” while fundamentally destroying the economic protections they have earned and deserve.