[dropcap]S[/dropcap]ince 1978, the first Sunday after Labor Day has marked Grandparent’s Day. Today is an opportunity to celebrate the contributions of our nation’s over seventy million grandparents. They play crucial roles in families around the country. Indeed, in millions of so-called “grandfamilies,” grandparents have primary responsibility for their grandchildren.

Social Security is an essential resource for our nation’s grandparents and their families. The vast majority of grandparents receive Social Security benefits. Two-thirds of Social Security beneficiaries aged 65 or older get half or more of their income from Social Security. One-third rely on Social Security for virtually all of their income.

Grandparents often provide the essential backstop for working families. Grandparents provide care to their young grandchildren, pick them up from school, and care for them after school. With parents working increasingly long hours to make ends meet in a difficult economy, the role of grandparents — and of the Social Security benefits they receive — is perhaps even more important than ever.

In “grandfamilies,” the role of the grandparent is not just helper, but primary caregiver. Nearly 8 million children live in families headed by grandparents or other non-parental relatives. In many of these families, one or both parents are deceased, disabled, or deployed with the military. The number of children living in multi-generational households has been rising in recent years, from 8 percent in 2001 to 11 percent in 2014.

For “grandfamilies,” the role of Social Security is especially important. Our Social Security system is the nation’s largest and, despite its modest benefits, most generous children’s program. If a worker dies or becomes disabled, his or her children receive benefits until age 18. In 2014, approximately 6.4 million children — 9 percent or one in 11 American children — benefited from Social Security either by directly receiving benefits, living in a household with a relative (often a grandparent) who receives benefits, or both.

Not surprisingly, Social Security is the most important source of income for families where grandparents are rearing their grandchildren. Without Social Security, 59 percent of grandparent-headed families would live in poverty. Even with Social Security, 21 percent of these families have incomes below the poverty line.

Social Security is an important and highly successful program. Its one flaw is that benefits are too low. Now is the time to increase Social Security’s modest benefits and add benefits to help our nation’s grandparents and families, including, of course, our “grandfamilies.”

Among other increases, we should increase the program’s minimum benefit, so that seniors who have worked hard their whole lives do not spend their golden years in poverty. We should reinstate the student benefit that existed before 1981, so that children whose working parent has died or become disabled can obtain higher education while incurring just a bit less debt. It’s long past time to expand Social Security to include paid family leave, as well as to include a caregiving credit toward future Social Security benefits for family members (including many grandparents in their 50s and early 60s) who take time out from the workforce to provide essential care.

All of these additional benefits fit perfectly within the overall framework of Social Security. After all, Social Security is insurance against the loss of wages. In addition to death, disability, and old age, wages are lost when workers become sick or when their families need them, whether as the result of illness or the birth or adoption of children.

After 80 years, Social Security has stood the test of time. It is incredibly efficient, spending less than a penny of every dollar on administration; the remaining 99 cents is paid in benefits. As the wealthiest nation in the world, at the wealthiest moment in our history, there is no question that we can afford to expand Social Security. The real question is how can we afford not to do so.

When President Franklin Roosevelt signed Social Security into law, he described it as “a cornerstone in a structure which is being built but is by no means completed.” True to this vision, prior generations have built additions onto this sturdy structure. Now it is our turn.

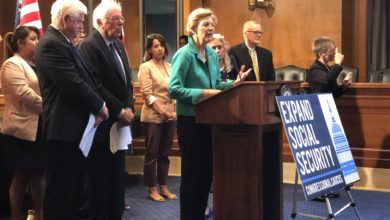

American people overwhelmingly favor expanding, and not cutting, Social Security. In the last few years, the Democratic Party has listened. Last year, Social Security expansion was endorsed by Democratic presidential candidates Bernie Sanders, Hillary Clinton, and Martin O’Malley. Social Security expansion was endorsed in the party platform. This year, over eighty percent of House Democrats have signed on to Rep. John Larson’s Social Security 2100 Act, which would extend the program’s solvency through 2100 while also expanding benefits.

Unfortunately, the same championing of Social Security hasn’t happened in the Republican Party. Instead, Republicans continue to demand cuts to Social Security’s already modest benefits. Donald Trump, who was elected president on a promise to protect Social Security, put out a budget proposal that includes cuts to Social Security, as well as many other programs that are vital for seniors and children. Not a single prominent Republican has embraced Social Security expansion.

That’s why the 2018 election will be so important for Social Security’s future. As in all midterms, seniors, including grandparents, are likely to cast a disproportionate share of the votes. If Democrats campaign hard on expanding Social Security’s protection for grandparents and their grandchildren, American families will hear the message. If, through our votes, we elect people who will enact Social Security expansion, we will all have a more secure future.